Remote Deposit

- Remote Deposit Definition

- Remote Deposit Capture Adapter Error

- Remote Deposit Capture Risks

- Remote Deposit Rn

- Remote Deposit Bbt

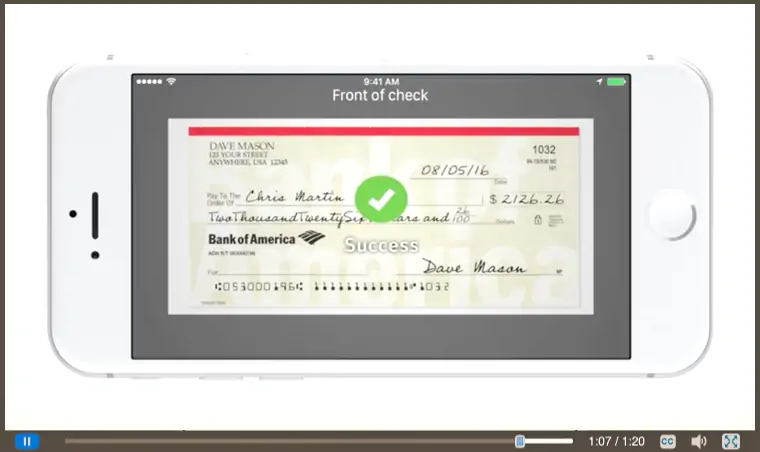

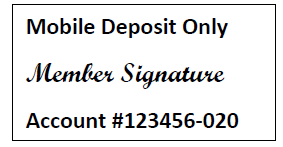

Banner Bank is an established community bank serving Washington, Oregon, California, and Idaho. Explore our checking & savings accounts, low-interest loans, credit cards, and more. Remote deposit is a way to process payments without sending paper checks to your bank or credit union. By scanning an image (or taking a photo) of checks instead of moving physical documents around, you get faster deposits and fewer errors. 1 Who Uses Remote Deposit? Businesses: Businesses were the first users of remote deposit technology. With Small Business Remote Deposit Online, you can use remote deposit capture technology to make multiple deposits to your small business account from your home or office for a low monthly fee. 1 Watch a remote deposit demo Multiple check deposits from your home or office. With Chase QuickDeposit, our remote deposit solution, you just scan your paper checks and send the scanned images electronically or through mobile deposit to Chase for deposit into your checking account. Chase QuickDeposit can help you streamline your deposits and gain access to your funds. Help With Security Setup Microsoft.NET Plug-In not supported with current security settings.

Streamline your receivables

Every paper transaction you convert to electronic helps to add speed and increase your ability to monitor overall cash flow.

Put your collections online

Our electronic receivables can change the way you do business, which may help you:

- Streamline your A/R process.

- Increase transaction accuracy.

- Speed up collections.

- Decrease fraud risk.

- Improve customer satisfaction by accepting more payment formats.

- Reduce float and receive your payments faster.

Remote Deposit

When you deposit checks from your place of business, you can improve cash flow and receive information quickly while helping reduce the time, cost, risks, and waste resulting from physically transporting check deposits.

Wells Fargo has two ways to help you make remote deposits:

Desktop Deposit® service

Using a certified scanner, computer, and Internet connection, or simply an iPhone, iPad, or Android device, you can deposit checks through the Commercial Electronic Office® portal or through the CEO Mobile® Deposit service.

Wells Fargo Electronic DepositSM service

Using your existing process to capture check images and data, you can create and securely transmit a file to Wells Fargo.

The Wells Fargo advantage

- Extended deposit times. You have an extended deposit deadline for same-day ledger credit of 7 p.m. PT/ 10 p.m. ET.

- Lower bank fees. You can consolidate banking relationships, which may save money on account maintenance fees, and help you reduce time reconciling multiple bank accounts.

- Access to deposit images for up to seven years. An extended deposit image archive lets you view all your paper and electronic deposits online using the Transaction Search service.

- Benefits for your business and the environment. Not only will your company save on the cost of transportation and insurance associated with taking checks to the bank for deposit, but you’ll also reduce your ecological footprint by eliminating CO2 emissions.

Remote Deposit Definition

We believe in delivering the perfect client experience and place the highest priority on protecting your confidential information. For security purposes, we have temporarily suspended online access to your account.

Remote Deposit Capture Adapter Error

To access your account, please:

Remote Deposit Capture Risks

- Visit a BB&T branch or ATM

- Log in to the U by BB&T® mobile app

- Send a text to MYBBT (69228) (if you have a mobile number registered with BB&T)

- Call our online banking support at 888-228-6654 and provide us the reference code below

Remote Deposit Rn

Reference Code: (18.e4b2f748.1615062928.86e0b1e)

Remote Deposit Bbt

Thank you for your patience, and please accept our apologies for any inconvenience this may have caused.