Ei Direct Deposit

Direct deposit is an electronic transfer of your weekly Unemployment Insurance payments into your bank checking account. It offers increased convenience and allows you to access your funds via your own bank account. You can have your benefits electronically deposited into your checking account as long as your financial institution participates.

- Definition: The currency deposit ratio shows the amount of currency that people hold as a proportion of aggregate deposits. Description: An increase in cash deposit ratio leads to a decrease in money multiplier. An increase in deposit rates will induce depositors to deposit more, thereby leading to.

- There is no one time that “most” deposits post. It all depends upon when the transaction arrives at the bank's computers and the bank's posting procedures. The Automated Clearinghouse (ACH) system runs 24 x 7 x 365. It knows no weekends or holiday.

- If you expect to receive at least one of the following payments for your business from the Canada Revenue Agency, you can sign up for direct deposit: corporation income tax refund goods and services tax/harmonized sales tax refund refund of excise tax or other levies.

Ei Direct Deposit Time Td

You should inform each of your payors immediately if your banking information changes. Some financial institutions offer a service where they do this for you. If the changes are the result of a merger or closure, your financial institution might also contact your payors to inform them.

I received a direct deposit in my account and I don't know what it's for, or who it's from. How can I find out?

Contact your financial institution so they can investigate.

Receiving your payments by direct deposit offers many benefits. It allows you to access your money faster and is more convenient as your payment will not be delayed due to unforeseen circumstances such as bad weather. It is reliable and your payment will always be deposited on time in the bank account that you supply at the time of your enrolment in direct deposit. Direct deposit is secure because your payment cannot be lost or stolen.

Salaries as well as provincial and federal government benefit disbursements or tax returns are examples of payments commonly made through direct deposit.

In the case of Government of Canada payments, you can receive payments such as your income tax refund, benefits and credits such as the Canada child benefit (CCB), the goods and services tax/harmonized sales tax (GST/HST) credit, Canada workers benefit (CWB), and provincial and territorial payments such as the Ontario Trillium Benefit (OTB). If you are eligible to receive it, you can also receive your Canada Emergency Response Benefit payments. For more information, visit: Government of Canada Direct Deposit.

Does direct deposit allow the payor to take money from my bank account?

No. When you enrol in direct deposit, you don't authorize the payor to withdraw money from your bank account. The information you provide can only be used to deposit money into your account.

Does using direct deposit mean the payor can monitor my bank account?

No. By enrolling in direct deposit, you don't give the payor permission to monitor your bank account. The information you provide for direct deposit is protected under the Privacy Act and access to your account is protected by your agreement with your financial institution.

Do I need a computer or Internet access to use direct deposit?

No. You can enrol in and use direct deposit without a computer or Internet access.

For more information, contact your financial institution. Let them know you're signing up for direct deposit and they'll give you the information you need.

Once you've enroled, you can continue to use your financial institution as you normally would: in person, at an ATM, online or over the phone.

I was asked to provide a void cheque in support of a direct deposit request, why?

A payor might also ask you for a void cheque. They do this to verify the accuracy of the information you provide to them. It's safe to give your payor a blank cheque for this purpose. But to protect against fraud, be sure you write 'VOID' across the front of the cheque in ink, and don't sign it.

If you don't have a cheque or if you need help, contact your financial institution. Let them know you're signing up for direct deposit and they'll give you the information you need. Alternatively, many online banking services provide account holders with direct deposit information that you can provide to the payor, including a form you can download and use in place of a void cheque.

Direct deposit is a method of payment where a paying party, such as an employer or government agency, electronically transfers a payment from its bank account into the bank account of the payee.

Direct deposit is a fast, safe and convenient way to receive payments, like having your pay cheque deposited directly into your bank account.

Once the funds are in my account, can a direct deposit be reversed?

Yes. Any errors in direct deposit can be corrected up to three (3) days after the funds are available to you.

Ei Direct Deposit

Of course, our rules take into account the needs of consumers, businesses and financial institutions. You can refuse an error correction made to a direct deposit within 90 days, as set out in section 35 of Rule F1.

If you notice a suspicious reversal in your account, you should contact your payor for information. If you can't resolve the situation with the payor, and you believe that you are legally entitled to the funds, you can contact your financial institution. Your financial institution may be able to assist you by refusing the error correction. The funds will be withdrawn from the payor's account and returned to your account.

You can open yourself to legal action if you keep funds that don't belong to you.

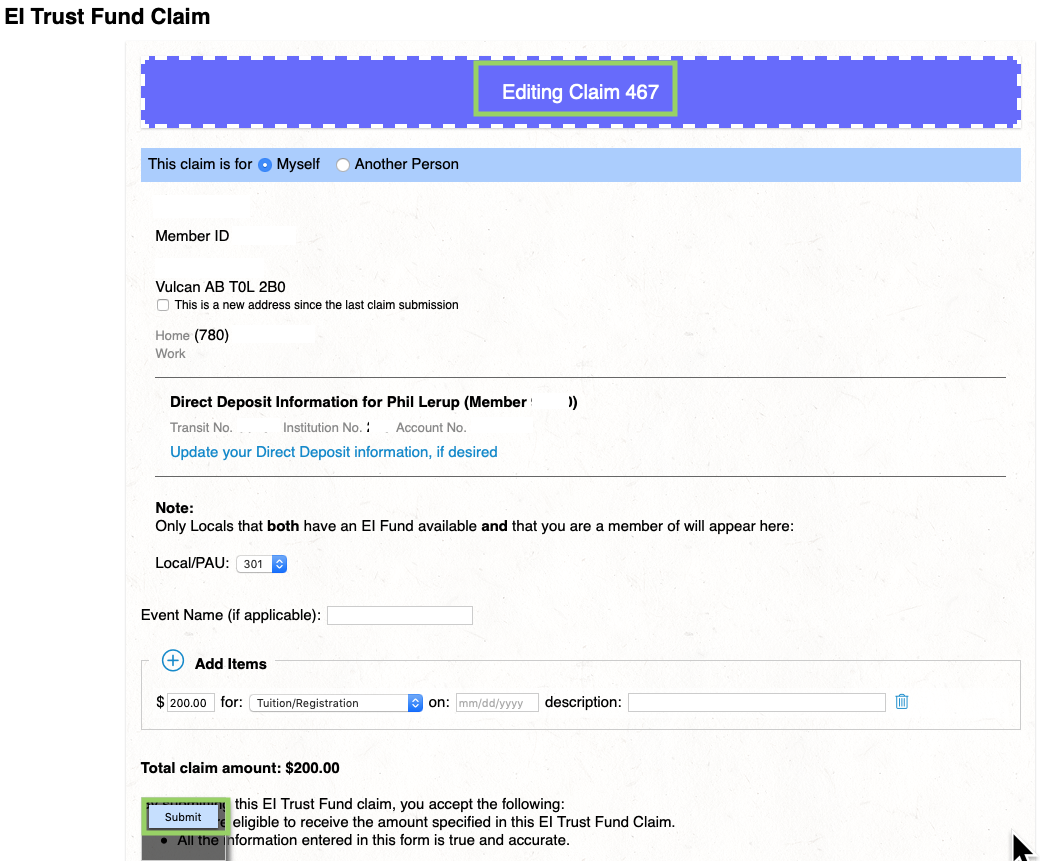

This page shows your options for direct deposit with My Account.

Please choose one of the following three options:

- Continue to manage direct deposit

If you do not want the CRA and ESDC to share your information, or if you are not receiving CPP payments, choose this option. - For payments from the CRA, use the deposit information on file with ESDC

To choose this option, you must be receiving CPP (Canada Pension Plan) payments. This option will let the CRA ask Employment and Social Development Canada (ESDC) to send your deposit information to the CRA. The CRA will use that information for your CRA account. - View or update your direct deposit information for income tax refunds, WITB payments, and GST/HST credit payments, and share the information with ESDC

To choose this option, you must be receiving CPP payments. This option lets you send deposit information to ESDC for your CPP payments, and you can update information and send it to ESDC for your CPP account.

After choosing your option, select “Next.”

Consent to share direct deposit information

If you choose to have your deposit information shared between the CRA and ESDC, select “I agree,” followed by “Next.” To return to the previous page, select 'Previous.'

If you decide to not allow your information to be shared between the CRA and ESDC, select “I do not agree” followed by “Next.” Then you will see the “Manage direct deposit” page.

Direct deposit confirmation

This is confirmation that your banking information has been accepted by the CRA and that the information will be sent to ESDC to use for your CPP payments. To exit the direct deposit application, select “Return to home page.”

Request to share information is not accepted

If ESDC does not accept your request to share information, you will receive the following message:

Canada Ca Cra Direct Deposit

“ESDC was unable to process your request to share your Direct Deposit information. Please contact ESDC at 1-800-277-9914 for more information.”

Ei Direct Deposit Form

Non-acceptance could be for several reasons: for example, you do not receive CPP payments; or your family name or date of birth on file with ESDC does not match CRA records.

This message will stay on your account for three months.